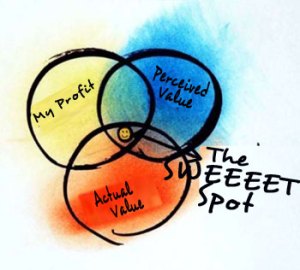

Find that pricing sweet spot that ensures excellent profits and willing buyers. This is not so easy to figure out at first, but the market will tell you whether or not you are in that good place.

For example: I owned a house that was appraised by the bank at $550,000. Since I paid $240,000 for it a few years earlier, I assumed I had equity of $310,000. When I sold it, buyers were not flocking to my door. It sold for $375,000. THAT was what the product was worth, not the amount the bank assigned it.

The actual value was what the buyer was willing to pay. This was an important lesson for me!

As a business owner, you must find that sweet spot and not worry about anything else. Simple question: will they buy more at this Price A or Price B? Can I be profitable at price A? If not, do I have a viable product that is marketable?

In your pricing considerations, you may compare yourself with competitors. Do not let that lead you to over- or under-confidence. Pay mind to your product and its value to your customer. That is the only consideration that matters. The buyer will accurately calculate the value of your product. If you have consistent sales, you have found the sweet pricing spot.

Do not fall into the complacent merchant mode. Since you are selling well, you may think that raising your price will enhance your profits – and it will, if and only if, you maintain the level of sales you have grown to love.

Raising your price may make your customers rethink the attractiveness of your product. They may stop buying and you may fail to attract new customers at the revised price point. Be sure to verify that a price increase will enhance your sales, your profitability and your business. Do the appropriate research before you alter a successful pricing structure.

To sing all the way to bank, you must have the right product at the right price to market to the right customer base: the oh-so sweet spot.